7 Travel Tips for Your Money and Identity

July 29, 2016

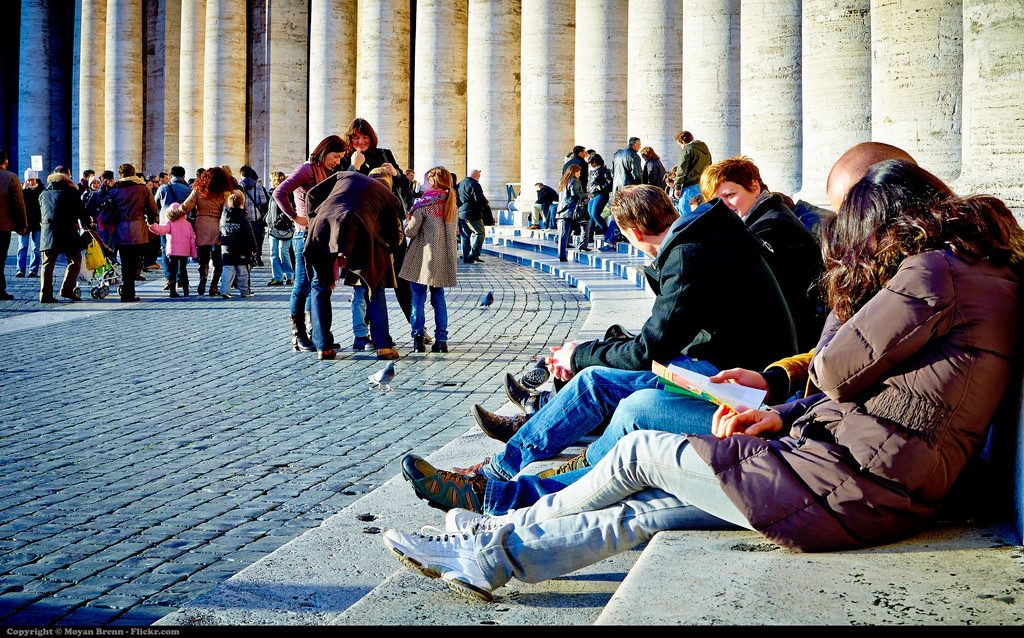

Travelers and tourists are a dream for thieves. They’re typically carrying plenty of cash and valuables. They often have smartphones full of personal information. And, they can easily get caught up in the sights and forget to be aware of their surroundings.

While the threat of losing money, jewelry or a camera is bad enough, there’s also the risk of identity theft. Each year, criminal activity related to identity fraud totals $15 billion in the U.S. alone, according to the 2016 Identity Fraud Study by Javelin Strategy & Research. And, the cost is more than financial — it can be maddening to try to get everything back in order.

That’s why it’s important to protect yourself, even when you’re on the go. Here are seven ways to do just that, from USA Today, the U.S. Justice Department and even the U.S. Department of State.

1. Don’t be scared of cash. You don’t want to carry around too much, of course, because it’s not replaceable. But, unlike credit cards, having money stolen won’t add to your risk of identity theft. You can still use cards, particularly to take advantage of your card’s purchase protection when buying expensive items. Just think about whether the merchant or restaurant is likely to have a secure system. If you do prefer cards over cash, don’t take every single card you own and do check your statements carefully when you return.

2. Watch where you get and keep cash. Use ATMs affiliated with banks you know, if at all possible. Your travel partner should stand behind you to keep others from viewing your PIN. Watch for “skimmers,” too — thieves install these devices on legitimate ATMs and other card readers to capture your information, and they’re hard to spot. If anything looks different about where you swipe your card, avoid that machine. And, once you have your cash, keep it somewhere secure, such as in a front or hidden pocket with a zipper or a bag you can wear across your body.

3. Lock your smartphone and computer. Our phones and computers are full of personal information, and auto-login features for apps, including financial ones, can be a bonanza for thieves who gain access. Lock your devices with a code only you know, and don’t make it obvious, like “1234.” Also, some phones have a remote-shutdown feature, so you can wipe its contents if it’s lost. Enable this at home, before leaving for your trip.

4. Be careful with wireless. Public wi-fi access is convenient – and dangerous. Others on the same free or shared network may be able to see the data, such as passwords and credit card numbers, you transmit. Avoid logging in to financial websites, if possible. If not, stick to encrypted websites (with “https” at the beginning) and log out after each session. Update your password the next time you’re on a secure network.

5. Always stay alert. When you’re in public, beware of crowds, disturbances or people “accidentally” bumping into you. These are common ways pickpockets steal items without being detected. Don’t sleep while using public transportation, even long train or bus rides. And, each place you go, locate the nearest exit so you can escape a dangerous situation if needed.

6. Use the hotel safe. They aren’t perfect, but storing your passport and other important things in the safe while you’re out and about is far better than leaving them out in your room. And, it is best to leave some things behind while you’re exploring — using your passport everywhere for identification, for example, puts you at risk of losing it.

7. Don’t forget the home front. While you’re away, burglars could gain access to the personal information you have at home. Stop your mail and newspaper delivery, or arrange for a neighbor to pick it up daily. Leave a few lights on or put them on timers so it looks like someone’s home. And, keep your important documents in a secure place. A home safe is great, or you could even consider a safe-deposit box, if necessary.

By taking just a few precautions, you can increase the likelihood that your trip will be enjoyable — or that it at least won’t end in a financial disaster. One more thing to consider? Identity Recovery Coverage from Safeco, which can help take some of the sting away if, despite your best efforts, you become a victim of identity theft.

Now, get out there and explore!

Reposted with permission from the original author, Safeco Insurance®.

Top image by Flickr user Moyan Brenn used under Creative Commons Attribution-Sharealike 2.0 license. Image cropped and modified from original.